The battle against inflation during the Biden years is almost behind us. But we’re in danger of learning the wrong lessons from it.

The Federal Reserve, holding its last meeting of the year this coming week, has been fighting runaway consumer prices for nearly three years. So far, at least, it has managed an unusual feat: The rate of inflation has dropped sharply from its peak and there has been no recession.

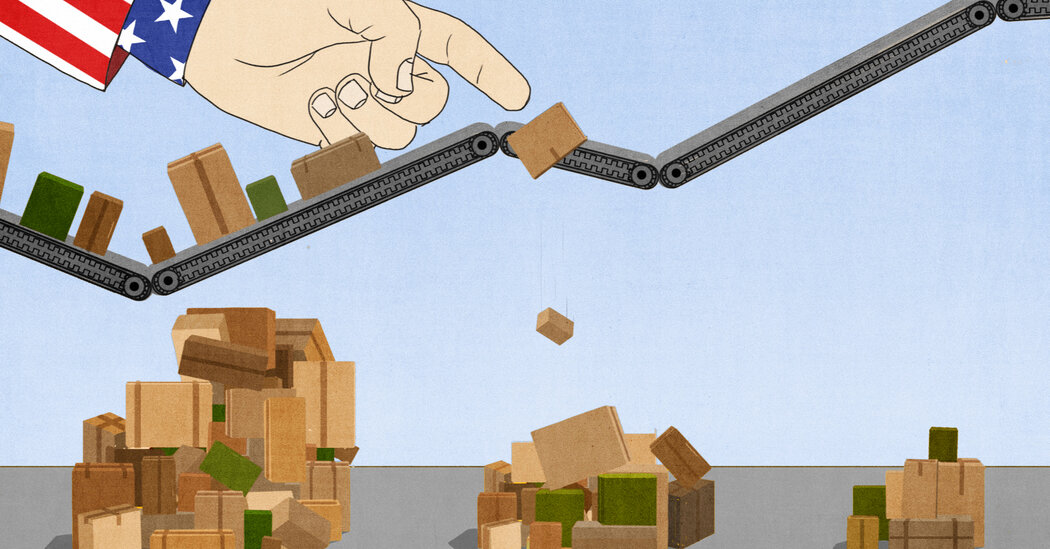

Yet the Fed is stuck in a difficult place. With prices still rising faster than the central bank’s 2 percent target, the incoming Trump administration will be hypersensitive about inflation, which was a decisive factor in the November elections. At the same time, the new administration’s policies on tariffs and immigration could set off another inflation surge. So the Fed must remain acutely vigilant on the inflation front.

But it will have to keep experimenting, to be ready for the curve balls coming from future recessions. Some economists believe the Fed would gain flexibility if it reconsidered its 2 percent inflation target, though they say the central bank can’t take that step now because it is under too much pressure to preserve its own institutional independence.

Still, a single-minded focus on inflation could leave the Fed without the right tools for coping with economic downturns ahead.

The Fed’s predicament reminds me of a general who is endlessly fighting the last war — conscientiously dissecting the tactics of recent battles and failing to prepare properly for the next ones.