Bitcoin (BTC) is not the only one setting milestones. HyperLiquid, the leading on-chain perpetuals trading protocol operating on its custom-built layer 1 blockchain, is setting impressive records, too, with the platform seeing more activity in ether (ETH) than bitcoin.

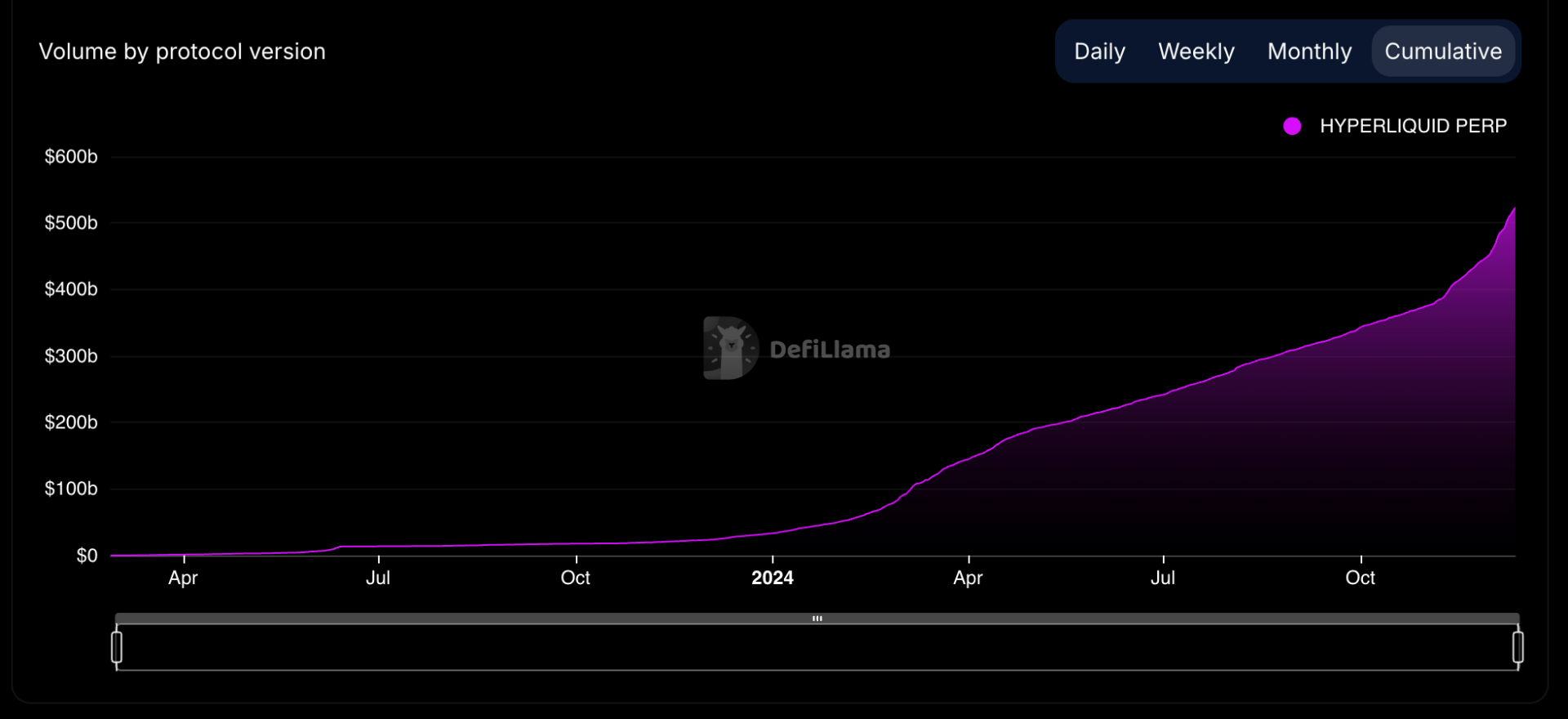

The cumulative perpetuals volume on the platform has surged past $500 billion, registering a staggering 15-fold year-to-date rise, according to DefiLlama.

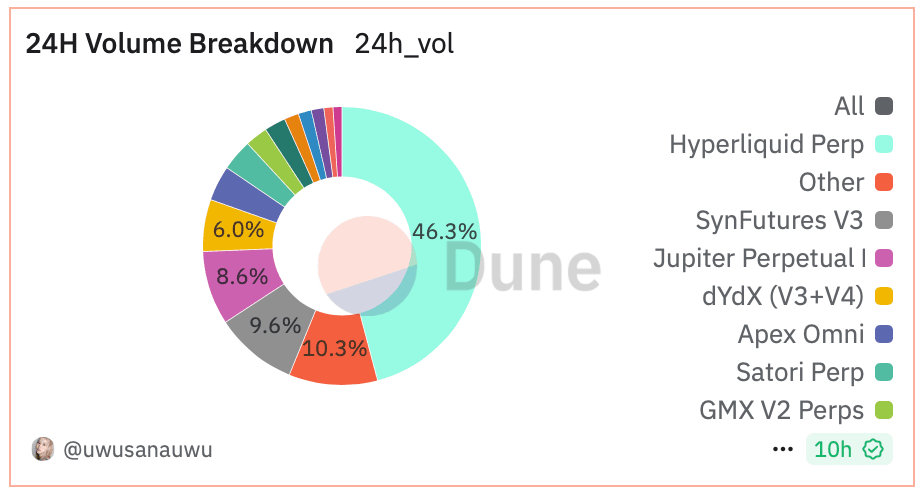

The platform has seen an average daily volume of over $5 billion in the past seven days, accounting for over 45% of the total onchain perpetuals market activity of the past 24 hours.

What’s more interesting is that ether, not bitcoin, is leading the boom in activity this week. Since Monday, ether perpetuals have registered a cumulative trading volume of $7 billion. That’s 18% greater than bitcoin’s tally of $5.94 billion, according to data source stats.hyperliquid.xyz.

Ether has also led the growth in the cumulative notional open interest on the platform since late November. At press time, ether perpetuals worth $857.5 million were active, accounting for nearly 25% of the total open interest of $3.49 billion.

The increased activity in ether on HyperLiquid represents sticky capital that could fuel the next leg up in the second-largest cryptocurrency by market value. As of writing, ETH was changing hands at $3,900, representing a 70% year-to-date gain, CoinDesk data shows.

The success stems from HyperLiquid being a purpose-specific protocol rather than a general all-purpose chain, according to some observers.

“HyperLiquid’s success appears rooted in prioritizing product-market fit, blending institutional-grade performance with DeFi accessibility, such as no KYC requirements. By offering more generous incentives for active traders, Hyperliquid aligns closely with user needs, potentially setting a new standard for future crypto projects,” algorithmic trading firm Wintermute said in a note shared with CoinDesk.

HYPE is bigger than AAVE

Speaking of market action, HyperLiquid’s two-week-old HYPE token is already making waves. The cryptocurrency has surged over 300% since its inception, zooming to a market value of $5.69 billion, bigger than long-established DeFi players like Ethereum’s leading lending protocol Aave and Solana-based decentralized exchanges Raydium and Jupiter, according to data source Coingecko.

The sustained bullish move following the record airdrop is a sign of investor confidence, according to Wintermute.

“Despite the potential for significant sell pressure from the airdrop recipients, the sustained demand for HYPE has consistently outpaced supply, indicating robust market confidence,” Wintermute noted.

On Nov. 29, HyperLiquid airdropped 31% of HYPE’s nearly 1 billion supply to users who held points earned through trading activities. The airdrop was valued at $1.9 billion, surpassing layer 2 solution Arbitrum’s $1.5 billion valuation.

HYPE is used as a staking asset to secure the platform’s HyperBFT consensus mechanism and acts as a gas token, facilitating transactions and smart contract executions.